No products in the cart.

NEWS

Agriculture Sector Cost-Benefit Analysis Guidance

Aaron Szott and Mesbah Motamed, MCC

Introduction

MCC is required by statute to conduct cost benefit analysis (CBA) and to calculate the economic rate of return (ERR) on projects supported through compacts.1 ERRs are a critical part of the project approval process and are required to exceed a threshold level of ten percent over the life of the CBA.2 Economists in MCC’s Economic Analysis (EA) Division conduct CBAs in a variety of sectors, including for programs based on policy and institutional reform. To clarify sector-specific methodology and to achieve an appropriate level of consistency across models, the EA Division is developing sector-specific CBA guidance. The CBA guidance for the water and sanitation (Osborne, 2019), land (Bowen and Ngeleza, 2019), energy (Epley et al., 2021), and transport (Carter, 2020) sectors have each been completed, and guidance for the education and health sectors are forthcoming. This guidance focuses on agricultural projects and is intended to serve three purposes: 1) to help economists charged with developing CBAs understand available methodological tools, and the relationships between various project types and features and ERRs; 2) to provide greater clarity to external practitioners and economists in partner countries and other agencies on the methodologies used at MCC to construct CBAs and estimate ERRs; and 3) highlight key project monitoring considerations. This is a living document that will be updated periodically.

As of December 2022, MCC had funded $1.7 billion in agricultural interventions spanning infrastructure, producer organizational development, policy and regulatory reform, market development, resource management, research, and finance. Weighted by the dollar value of programming expenditures, most agriculture investments have centered on irrigation infrastructure. Benefit-cost ratios associated with and independent evaluations of MCC’s agriculture projects have produced a mixed record. On one end, costly irrigation investments have yielded modest results, while on the other, some policy reforms appear headed for high payoffs.3 Before considering the details of MCC’s agricultural interventions, the next section reviews the ways in which agricultural productivity typically evolves and contributes to broader economic growth.

Agriculture, Economic Growth, and Poverty

MCC aims to reduce poverty through economic growth. Agricultural growth in particular can play an outsized role in poverty reduction, and (on a per growth episode basis) is estimated to reduce poverty two to three times more effectively than is the case for non-agriculture sectors (Christiaensen and Martin, 2018). In developing economies, agriculture figures critically in structural transformation, the process by which an economy transitions away from rural, subsistence agriculture into more modern activities, including commercial agriculture as well as (primarily urban) services and manufacturing. Countries with large shares of labor in agriculture, large rural shares of population, and low agricultural productivity struggle to create conditions for rapid, sustainable growth. The mechanisms that transform such economies occupy a lively literature, and agriculture’s role, its contribution to human survival and health through the production of food, stands out.4

In stylized two-sector, closed economy models of structural transformation, most workers begin in subsistence farming and exhibit preferences such that food consumption precedes that of all other goods until caloric and nutrition needs are met (Gollin et al., 2002, 2007). In one transformation scenario, agricultural productivity growth raises crop yields, first satisfying agricultural workers’ food needs and, later, generating a marketable surplus. Income from the sale of these surpluses stimulates demand for goods and services produced off-farm. Meanwhile, owing to these same surpluses, food supplies increase and prices fall. Over time, per-worker productivity improvements reduce demand for on-farm labor, including children who are freed to attend school. Also, and critically, lower food prices both raise real incomes off-farm and lower labor costs for firms. No longer dependent on land for food, workers migrate to cities, where opportunities for growth further proliferate across a more diverse array of activities. This pattern of transformation, observed over history across Europe, the Americas, and throughout East Asia, presents a straightforward model of agriculture’s role in driving early-stage economic growth.5,6 As Section 3 below makes clear, explicit consideration of structural transformation highlights several novel ways in which MCC economists might model benefits from agriculture projects.

Structural transformation and its attendant economic growth can take generations to unfold, but in principle, productivity growth in agriculture can also help achieve short-term gains in income, particularly among poor farmers and anyone able to obtain employment within better-developed value chains. More input use, improved technologies, better transportation and storage infrastructures, and more market information can all contribute to higher farm-household incomes and a raft of other indicators of well-being, e.g., higher consumption, asset growth, improved nutrition and poverty reduction (Gollin et al., 2021; Takahashi et al., 2019). Among these inputs are seed varieties bred for higher yield, drought- or flood-resistance, or enhanced nutrient content, as well as yield-boosting fertilizers and pesticides. Better technologies supported by markets and training, including irrigation, mechanization, and soil mapping, not only confer direct benefits in terms of reduced input and labor costs, but also amplify the benefits of seed and fertilizer inputs. Transportation infrastructure, in addition to connecting rural producers to larger markets, can also ease access to critical inputs such as fertilizer. Better roads allow perishable goods to travel longer distances with less spoilage and loss. With better storage options, producers can ease the seasonal glut of harvest and its attendant downward pressure on prices (Omotilewa et al., 2018). Storage also boosts producer sale price prospects by allowing sellers to consider higher offers in the future.

But research points to several causes behind farmers’ inability or unwillingness to adopt more modern practices and technologies (Suri and Udry, 2022). Farmers could simply lack information and skills. Export restrictions can discourage cultivation in cash crops. Credit constraints are often present. Without cash on hand, farmers must rely on finance to obtain inputs for production, but well-known market failures prevent loans from being available. (See Section 8 for a discussion on Blended Finance.) Missing markets in insurance further expose growers to risky production and market conditions, and ultimately financial or health jeopardy. Aversion to risk is particularly high among poor farmers who must weigh uncertain gains against the possibility of starvation or destitution, which can discourage adoption of unfamiliar technologies (Omotilewa et al., 2018). Other crop features, including storability, taste, and processability, also factor into farmers’ adoption decisions.7 Adoption decisions and outcomes are also affected by how new technologies fit within the livelihood and income strategies of farmers that differ by socioeconomic status, gender, and cultural context, facing different vulnerabilities, power relationships, and institutional environments.8 Finally, climate change can be expected to aggravate the already substantial problems described here. Understanding these multiple, simultaneous challenges and how MCC interventions can help address them are ongoing themes of this guidance.

Separately, the question of beneficiaries arises. Traditionally, projects in agriculture aim to raise the productivity and, by extension, the incomes of smallholder, subsistence-oriented farmers.9 A major challenge with this approach is the tension between the scientific and skill-intensive characteristics of modern production agriculture and the capacity of smallholders to absorb technical knowledge and orient their production to markets, particularly in settings where rates of literacy and numeracy are low. This “human capital” constraint underlies much of the challenge in effectively applying inputs, accessing finance, and delivering services to many farmers in low-productivity settings. For these reasons, smallholders have often proven to be difficult targets for productivity improvement.10

As an alternative, projects can focus on improvements to agriculture as a sector and in turn, identify broader poverty-reducing benefits. Rather than targeting interventions to smallholders, projects may simply target the rural poor, recognizing that the majority are best served by opportunities for either commercial agriculture or off-farm employment. Rural investments in agriculture-adjacent activities (e.g., input supply, food processing, transport and logistics, and cold chains) present an opportunity for the rural poor to escape subsistence farming and either move into commercial agriculture or engage in waged labor that at once absorbs and sustains upstream production and diversifies the labor force into manufacturing and service sectors. Where market or policy failures prevent such investments from being made, MCC could help.

In this case, benefits could accrue not just to more productive farmers and newly employed workers off-farm, but also to consumers whose access to affordable, nutritious food rises. Lower food prices raise real incomes, a critical benefit to poor households that spend up to half their budgets on food. And as highlighted above, with higher real incomes, demand grows for non-food goods and services, including housing, healthcare, education, as well as consumer products, triggering the diversification and growth of the economy, both rural and urban, across an array of sub-sectors. In parallel, as on-farm productivity rises (e.g., through mechanization), demand for on-farm labor falls, freeing women, children, and youth to pursue off-farm jobs, more education, and other productive activities. While a large literature documents these multiple streams of benefits, many of these outcomes do not materialize quickly, cannot be easily tied to a particular intervention, and are often difficult to observe and measure. All this may complicate efforts to identify and quantify benefits for CBA purposes, but notwithstanding these challenges, recognizing these benefits not only can help guide the design of investments, but also inform discussions surrounding CBA work and offer additional context to decision makers weighing investment decisions.

Finally, there are potentially sizable economic gains associated with addressing the generally weak position of women in commercial agriculture. Gender norms, including those related to domestic responsibilities, the freedom to occupy public space, control over household assets and labor, and norms which define cash crops as inherently “male,” drive substantial gender gaps in agricultural productivity and often lead women to concentrate in lower-value cultivation and limit their access to markets and storage facilities.

Overview of Agriculture Interventions

The challenges and risks facing producers in the agriculture sector and the range of actors across its diverse value chains motivate an overview of the broad landscape of agricultural interventions.11 Beginning with on-farm production, research and donor agencies have addressed a variety of critical inputs:

- Seeds: In most low-productivity settings, low quality seeds are a common technical constraint. Efforts to develop genetically modified crops, or breed, distribute, and regulate seeds of higher yielding, more climate-resilient, and more nutritious varieties, optimized for a location’s soils and climate, can have a variety of impacts. In particular, such efforts can raise yields, reduce down-side risks, and ultimately improve the health and livelihoods of rural households. (Examples here and here.)

- Water: Improving access to water, whether through irrigation or improved water resource management, can dramatically elevate the productive potential of farmers, raising and stabilizing their yields, permitting multiple crops per season, diversifying the mix of crops, and generally protecting farmers from droughts. With irrigation-related technology arises the need for power sources for operation, and on- and off-grid solutions for power become relevant (Mashnik et al., 2017). Also, as we discuss below, successful irrigation investments frequently involve new forms of governance and legal arrangements.

- Fertilizer, pesticides, and other chemicals: The absence, mismatch, and low quality of agro-chemical inputs in many low-productivity settings depress yields, and as with seeds, efforts to develop and distribute modern chemical inputs can generate outsized returns. (Examples here and here.)

- Land: Secure and stable access to land, whether through customary or statutory law, represents a key element to long-run agricultural productivity growth. Where access to land is unclear or inequitable, investments to formalize tenure within a sound legal framework can stimulate more, and higher-value, investments in long-run agricultural land use. (Examples here.) For more on the benefits and costs of land use and land rights formalization programs, see Bowen and Ngeleza (2019).

- Management: In low-productivity settings, human capital constraints play a significant role in suppressing output. Strategies to educate farmers, whether through formal schooling, training, or extension services, can contribute to not only better farm management practices but also broader natural resource stewardship and sustainability goals.

Interventions to support on-farm production, while critical, represent just the first step along the agriculture and food value chain. Post-harvest investments can target several key activities, each of which create additional value while simultaneously determining the quantity and quality of food that reaches the final consumer (Bellemare et al., 2022):

- Transportation: Moving harvested crops from the farm to their next destination, be it a nearby market, a storage elevator, or a processing facility, requires a network of roads (and sometimes rails) that can convey goods quickly and affordably. Similarly, poor quality transportation networks also raise the cost of inputs. In developing country settings, rural roads that serve farmers, to the extent they even exist, are often in disrepair and poorly maintained, limiting the geographic extent of a grower’s market, raising the costs of transport, and increasing the rates of crop spoilage and losses en route. Investments that address the construction, repair, and maintenance of road networks can reduce these costs for growers and transporters.12 See Carter (2020) for MCC CBA guidance for transport investments.

- Storage: Insomuch as transportation presents the possibility of spatial arbitrage, storage confers the same function temporally. By storing commodities, growers and traders dampen the seasonal pattern of prices driven by harvest time gluts and pre-harvest scarcity. Storage also permits sellers to better time their sales and exert relatively more power vis-à-vis buyers who otherwise might offer a lower price knowing that a crop will otherwise rot. Relatedly, storage preserves the edibility and value of food over longer stretches of time, reducing losses owing to spoilage. Storage consists of a variety of technologies, including elevators with dryers, silos, cold facilities that preserve perishables, and even small bags that preserve foods from pest infestations.13 (Examples here and here.)

- Processing and packaging: Processing and packaging raw food commodities into final products is a key step in adding and preserving value. Drying, de-husking, de-stoning, milling, quality sorting, and other processes render food more edible and amenable to transport and storage. Other processes entail the application of heat and other chemical inputs, like converting raw milk into the range of familiar dairy products, e.g., butter, yogurt, cheese, or ice cream. Processing equipment often relies heavily on electricity, the absence of which, correspondingly, limits the potential and profitability of value-adding activities.14 (Examples here and here.)

Apart from tangible inputs along the food value chain, a variety of institutional and policy-related factors can meaningfully shape the market and performance of the entire sector:

- Market information: A sizeable literature has studied the role of information on production, demand, and prices in determining the opportunities and decisions facing actors in the agriculture sector. Generally, more access to information facilitates more efficient transactions and reduces potential for market power concentration, rent-seeking, and overall market failures. Efforts to publicize and disseminate price information could help producers choose a more optimal choice of crops, acreage, input use, harvest time, time of sale, and critically, a buyer. Technologies, such as mobile phones, that facilitate access to such information are one strategy to overcome barriers to information access (Deichmann et al., 2016; Aker and Mbiti, 2010). Other examples of technological solutions to information barriers appear here and here.

- Policies and institutions: The suite of policies and institutions that govern agricultural production and markets often plays a decisive role in the success of the sector (Torhonen et al., 2019). Policies that dictate and distort access to inputs, whether in the form of import restrictions or input subsidies, price controls, large parastatals that operate according to non-market priorities (e.g., political or social pressures), distortive trade interventions including export bans, and the effective de-prioritization of research, development, and extension services all can effectively constrain growers from achieving their highest potential. Broader policies governing land use, resource management, and taxes also weigh heavily on the agriculture sector’s outcomes. Separately, but equally important, are the competence, capacity, and transparency of institutions tasked with agriculture-related outcomes. Efforts towards achieving policy and institutional reform (PIR) include decreasing heavy-handed, prescriptive input subsidies, reducing the distortive role of state-owned entities, and building capacity among administrators in government. Illustrative examples of PIR projects are here and here.

- Access to finance: A persistent barrier to investments in productivity-enhancing tools and technologies is the limited availability of credit. On the supply side, efforts to mobilize capital through blended and leveraged finance instruments channeled through private lenders aim to deepen the available supply of funds and simultaneously reduce risks with the goal of growing lenders’ confidence in the agriculture sector. Examples of supply-side finance-related projects appear here and here. On the demand side, a growing recognition exists that many small and medium enterprises lack the elements of modern business recordkeeping and planning that make their operations “bankable.” Projects that address these shortcomings can narrow the gap between borrowers and lenders (Dokle and Farrell, 2021).

The interventions highlighted above address different problems, reach different beneficiaries, and result in differing impacts. MCC has worked in a subset of these areas and in the process gained valuable experience, to which we now turn.

MCC Work in Agriculture

This section offers an overview of the programmatic areas in which MCC has previously focused its agriculture investments. For ease of exposition and based on the typical features of the associated CBA models, we consider four sets of MCC agriculture projects: (1) irrigation infrastructure; (2) increased on-farm productivity and downstream value addition, (3) improved resource management, and (4) agricultural policy and institutional reform.15

Irrigation: MCC’s work in irrigation to date has primarily entailed the construction or rehabilitation of mostly large-scale centralized systems consisting of dams, dikes, canals, and pumps, complemented with farmer training, water user association (WUA) capacity building, land rights formalization, and other programming. The lack of investment in such systems often owes to coordination failures, due to the challenge of organizing hundreds of farmers spread across thousands of hectares to procure physical works on and manage a common water and infrastructural resource. Such failures can justify a public intervention to coordinate efforts. Although public management may appear to be a solution, challenges with capacity and resource constraints can give rise to additional problems, namely asset mismanagement and degradation. Additional barriers to investment relate to access to credit, given the high start-up costs of installations. To take a broadly typical example, MCC’s Moldova Compact featured the $129 million Transition to High Value Agriculture Project dedicated to the rehabilitation of irrigation infrastructure and WUA member training.16

Productivity and value addition: Inadequate national systems of education and agricultural extension services arguably explain much of the knowledge and skills gaps that impede farmers’ productivity growth. Meanwhile, low access to credit, driven by weak business practices, high transactions costs and risks, and information gaps between borrowers and lenders, significantly curtails access to productivity-enhancing technologies and equipment. In principle, interventions to encourage farmers to take up more advanced technologies via training or the availability of credit could be justified by reference to these market failures.17 MCC programs have invested considerably in addressing these gaps. For example, the Georgia Compact’s $52 million Enterprise Development Project set out to deliver long-term risk capital and technical assistance to agribusiness enterprises. long-term risk capital and technical assistance to agribusiness enterprises.

Resource management: Natural resource management interventions address the externalities associated with the individual or private use of water, land, and air, and the management challenges of collectively owned natural assets. Public interventions to sustainably manage and allocate such resources can ensure their long-run preservation, availability, and value. For example, in the Niger Compact’s $104 million Climate Resilient Communities Project, MCC funded PIR-style investments in the management of communal lands used for livestock intended to reduce “tragedy of the commons” outcomes as well as the restoration of degraded farmland that reduced water runoff on sloped plots (among other interventions). Benefits therefore accrue not only to the plot’s owners but also, critically, their neighbors’ plots.

PIR: A wide variety of government failures as they relate to the agricultural sector can motivate MCC support for PIR. MCC’s experiences with agricultural PIR investments is such that we opt to describe them individually rather than characterize them in more general terms. In Niger, MCC worked to address restrictive regulation of the importation of fertilizer. The Mozambique II Compact (which is still being developed at the time of writing this guidance) focuses on the reform of taxation as it relates to agricultural investment. These PIR investments have thus far tended to be focused on technical support of one form or another, and as a result they have cost less to implement relative to the typical project (at least in terms of MCC funding).It should be emphasized that many of MCC’s agriculture projects were not designed to address a binding constraint to growth as determined at the Constraints Analysis stage of compact development. This is mostly because more than half of MCC agriculture projects were implemented before MCC began to conduct Constraints Analyses (or used the results of those analyses to guide project development). In particular, all agricultural value addition projects and the majority of irrigation projects were not based on the results of a Constraints Analysis. Exceptions to this tendency have mostly involved projects addressing constraints related to irrigation or access to water for productive purposes. In (more recent) cases of agricultural projects or other programming still under development, associated binding constraints include agricultural policy and implementation (Mozambique II), the high cost of road freight transport services and barriers to linking farms to markets in rural areas (Malawi II), public administration (Lesotho II), and food insecurity (Sierra Leone). Indicators in Constraints Analyses of the potential benefits of irrigation include yield differentials between rainfed and irrigated plots, and the relationship between rainfall and GDP over time (which supports the idea that water for agricultural purposes can affect national economic outcomes).

Agricultural Project Logics and their Taxonomy

The logic of MCC agriculture projects usually hinges on behavior change among targeted beneficiaries. For irrigation investments to pay off, for example, farmers must switch to more lucrative crops, work to achieve higher yields, and properly operate and maintain new equipment.18 Each of these represent pronounced behavioral change in a subsistence agriculture context. Access to irrigation infrastructure perhaps encourages change on this scale, but it is likely insufficient on its own and is therefore typically complemented by “soft” program components to encourage the desired behavior change. Behavior change is just as important in the case of agriculture programs without an irrigation component, where (for example) farmer training and/or access to credit might be meant to affect a switch to a more lucrative set of crops or the use of more expensive inputs, as well as natural resource management programs.19 In all such cases, it is imperative that behavior changes are explicitly modeled in CBAs. Economists should integrate evidence-based parameters associated with the intended behavior changes into CBAs to support design work and for program evaluation purposes. Also, where behavior change cannot simply be assumed to take place on its own, programming to encourage it should be considered.

A salient feature of the context in which agriculture projects normally take place is the high degree of risk that economic actors face. It is therefore worth highlighting the potential benefits associated with the reduction of risk. Risk averse farmers often shy away from commercializing their production for fear that a failed crop might jeopardize their food security or land tenure. Research points to reduced crop area, reduced input applications, and a retreat to lower value, lower risk crops among producers who face outsized risks in production. To that end, risk-reducing inputs, e.g., drought resistant seed varieties and irrigation, can generate benefits by reducing downside risk to yield and mitigating the risks to income, thus creating opportunities for more commercial endeavors. Moreover, risks to income owe not just to unpredictable yields but also volatile prices. Coping with price risk certainly implicates production decisions, particularly with respect to crop selection, but also speaks to post-harvest activities, namely storage. Without storage, producers must sell their harvest all at once, creating gluts in the market and depressing prices. With storage, the boom-and-bust price cycle diminishes as stocks can be accumulated and dispersed in response to demand conditions over longer periods of time, effectively smoothing growers’ incomes. (On the other hand, if demand for storage was in fact high enough for it to be an economically worthwhile investment, it is not clear why it would not simply be privately provided. In the absence of a market failure, we might therefore presume, any benefits from storage would be outweighed by its costs.) Finally, where adequate legal frameworks exist, contracts between growers and buyers can confer greater certainty on a transaction, creating incentives for commitment and delivery and stabilizing prices in the market.

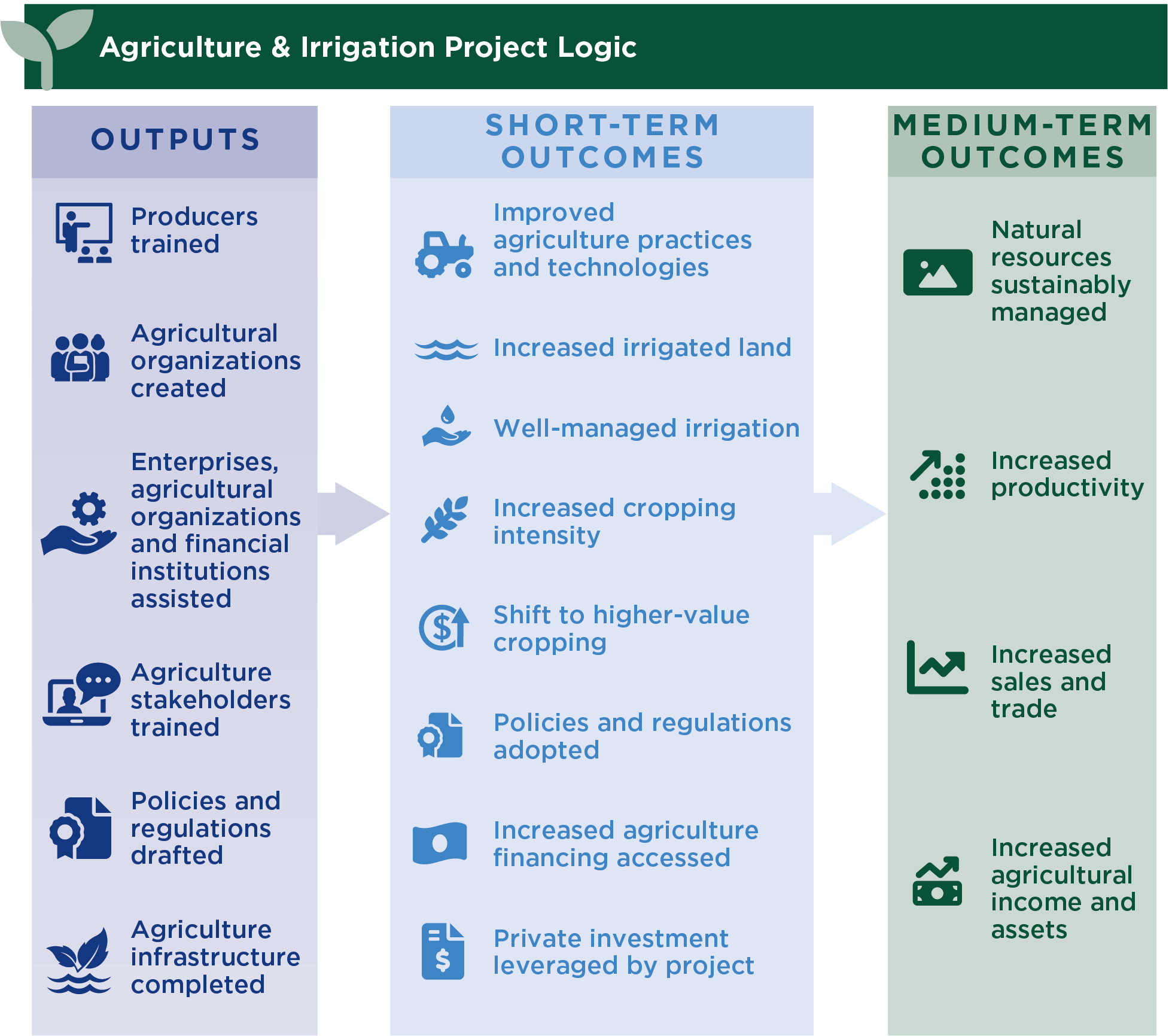

The relationships between project inputs and objectives are made explicit with project logics. More specifically, project logics outline the causal relationships between MCC investments and the outcomes underlying benefit streams, and they clarify the assumptions under which these relationships hold. Figure 1 displays how outputs are linked to outcomes for generic MCC agriculture and irrigation projects.

Figure 1: Generic Agriculture and Irrigation Project Logic

Project logics for agriculture projects normally assume that farmers will take up more lucrative technologies, that firms can increase their profits by participating in value addition activities, or that infrastructure will be maintained or new relationships between farmers and firms will be sustained. These logics are naturally context-dependent, in the sense that programming elements should be tailored to relevant conditions and needs. Also, to avoid logical leaps, project logics should consider multiple steps between project outputs being provided and the ultimate project objective. For example, if there is no tradition of cash crop cultivation in some project location where the logic invokes such cultivation, the design should explicitly address the introduction of cash crops to farmers and encourage their cultivation. In this case (and as shown in Figure 1), cash crop take-up by farmers would be included as a short-term outcome in the logic rather than something that was simply assumed to take place.

A key feature of agriculture projects that MCC has historically supported is that their objective is to increase agricultural household or agribusiness incomes. (See Section 3 for a discussion of outcomes of interest which go beyond incomes.) Table 1 displays the benefit streams typically associated with each of the three types of projects we consider and is followed by a discussion of some key assumptions underlying the logic for the project types.

Table 1: Agriculture Project Taxonomy Project Type Benefit Streams Irrigation projects: provision of irrigation infrastructure along with complementary inputs Increased irrigated land, increased cropping intensity, shift to higher-value cropping, improved agriculture practices and technologies, well-managed irrigation, increased productivity, increased sales and trade, and increased agricultural income and assets Value addition projects: attempts to encourage more lucrative cultivation and agricultural output value addition via some combination of training (including business development services) and access to credit Improved agriculture practices and technology, shift to higher-value cropping, increased agriculture financing accessed, private investment leveraged by project, increased productivity, increased sales and trade, and increased agricultural income and assets Natural resource management projects: agricultural sustainability or natural resource management investments Improved agriculture practices and technologies, policies and regulations adopted, private investment leveraged by project, natural resources sustainably managed, increased productivity, increased sales and trade, and increased agricultural income and assets Agricultural PIR projects: technical and policy support for institutional reforms affecting the agricultural sector Policies and regulations adopted, private investment leveraged by project, improved agricultural practices and technology, increased productivity, increased sales and trade, and increased agricultural income and assets

Irrigation and Agricultural Household Productivity

Irrigation provides farmers a way to control the quantity and distribution over time of water for crop cultivation purposes. This is of critical importance in settings where rainfall is low and irregular, and climate change stands to further aggravate these issues. Generally, however, it is reasonable to suppose that irrigation alone would not suffice to increase yields, encourage more lucrative crop choices, and lead to cultivation in an additional season, which each tend to play important roles in irrigation project logics. MCC therefore typically invests in complementary program elements including farmer training, land rights formalization, and the distribution of starter kits of seeds and other inputs.20 The idea is to invest in whatever combination of program elements will succeed in making beneficiary farmers willing and able to achieve more lucrative production, given sufficient understanding of the context (including prevailing gender norms, which could imply additional or different programming for women).

It is worth emphasizing that the assumptions underlying the logic of irrigation projects are potentially strong, and outcomes might not be achieved if these assumptions do not hold. First, the provision of outputs is not a simple set of tasks. Coordinating the implementation of several program elements in rural areas of MCC partner countries on time and in the correct sequence is frequently extremely challenging. Construction or rehabilitation of physical infrastructure tends to be the most complex and expensive program element by far (especially when resettlement is required), and delays in these works are common. This has implications for other program elements such as farmer training and WUA capacity building, which are ideally not undertaken until physical works are completed, when farmers can farm using improved irrigation and WUA can begin solving typical problems. Delays in construction or rehabilitation therefore have important cascade effects.

On the farm household side, the with-project scenario—with its higher crop intensification or emphasis on cash crop rather than staple cultivation—typically represents a drastic departure from the rainfed agriculture that beneficiary farmers tend to have long and formative experience with. Beneficiary farmers might have had one agronomic objective for their entire lives (and whose roots could go back generations)—namely, to minimize the likelihood of crop failure, likely by cultivating weather-robust but lower value staple crops—and whether the advent of improved irrigation and supplementary investments will suffice to change farmer economic objectives should be critically examined.

Farm and Agribusiness Value Addition

Historically, MCC agricultural value addition projects have typically involved training (including business development services for agribusinesses) and increased access to credit or grants. More recently, the Mozambique II compact goes beyond training and credit for farmers with the establishment of formal relationships between farmers and buyers of large amounts of agricultural output (or aggregators). These are referred to as outgrower schemes, and the idea is that in addition to benefiting from technical assistance and financial support of input purchases, farmers will be more likely to engage in more lucrative cultivation because there is an evidently interested buyer. For their part, aggregators are expected to realize increased profits owing to greater access to higher quality agricultural output.21 Similarly, MCC is supporting a project in Lesotho that is intended to link small farmers with foreign investors, such that the former can benefit from the so-called anchor farmers’ support with input provision, marketing experience, and access to export markets, and the latter can benefit from improved supply. The intention in all these cases was to encourage farmers to engage in more lucrative cultivation, and for agribusinesses to increase value addition activities.22 Again, the assumptions underlying these projects are non-trivial. Smallholder farmers typically display strong preferences for staple crop cultivation and seem to forego considerably higher earnings (in expectation) from cash crop cultivation so they can ensure their own household’s food supply. Switching to more lucrative crops is presumably an especially tough transition to manage in settings where year-to-year variation in output is high (due to adverse weather events or pests, for example), such that the risk of a lackluster cash crop harvest looms relatively large. Convincing farmers to behave more like expected income maximizers should therefore be regarded as a difficult undertaking, with all that entails in terms of initial problem analysis and subsequent project design work. Similarly, the reasons for a lack of value chain development might be many and compelling, and could go well beyond problems with financial resources and business plans. Caution is especially warranted in situations where a market failure has not been clearly identified, since in these cases it could simply be that firms’ decisions not to invest in agricultural value chains were rational because the investments were not economically viable. In the case of outgrower schemes, the key assumption is that buyers have the kind of long-term business interests that would justify years-long dedication to the establishment of trust from smallholder farmers. See Barrett et al. (2022) for more on the contextual factors most closely associated with well-functioning agricultural value addition, as well as key design-related considerations.23

We can also consider projects that contain elements of both irrigation and value addition projects, and more. For instance, MCC may consider development of projects centered on Special Economic Zones (SEZs) for agribusiness (including large-scale cultivation by anchor farmers), which would plausibly require an assortment of complementary elements including irrigation, improved roads, improved sources of power, and the policy and regulatory regimes specific to the zone. Such projects are obviously complex, and presumably associated project logics, risks and assumptions will reflect this. The overall question is perhaps what would suffice to induce agribusiness participation on the scale envisioned: Which factors have prevented agribusiness investment thus far, and which program elements therefore need to be in place for agribusinesses to participate? In settings with a sufficiently small agribusiness presence, credibly answering these questions is likely more difficult, since there will be less understanding of typical challenges to profitable operation. Duranton and Venables (2018) describe the many conditions which SEZs should meet in order to be successful and generate jobs: location should be chosen with markets for output, inputs, and labor in mind; the Zone should be large enough to generate agglomeration benefits; there should be evidence of comparative advantage; Zone-specific policies of several types should be implemented in an integrated fashion; and there should be long-term commitment from the highest levels of government.24 Also, if multiple program elements—each of which might be complicated-need to be implemented in a particular sequence, implementation risks are likely higher.

Natural Resource Management and Agricultural Productivity

Land is crucial for farming and livestock production and is subject to well-known market failures that result in decreased productivity and degradation. More specifically, to the extent that land is communally used or investments on one plot improve land productivity on surrounding plots, private land users will underinvest and land productivity will be low. Public interventions to improve land productivity are therefore called for, and MCC has experience implementing these kinds of interventions in the cases of livestock rangeland and degraded farmland.25 These interventions normally consist of physical works and complementary governance (for communal land investments) or training (for plot-level investments) elements to increase sustainability. Key assumptions for these investments are that natural resource improvements will be sustained and that farmers and herders will take advantage of this in a way that increases their household incomes.

Agricultural PIR

Policies and institutions are sometimes such that investments in agriculture are unduly stifled. In a handful of examples, MCC has supported associated reforms by funding the provision of technical and policy assistance. MCC’s Niger compact supported reforms to the regulation of fertilizer importation with the intention of increasing private sector involvement and the quantity of fertilizer imported. More specifically, MCC began focusing on Niger’s fertilizer supply problems starting in the compact development period, given what appeared to be severe supply restrictions: a small number of firms were granted the right to import fertilizer and were compensated using budgeted funds (with little regard for how much fertilizer those funds were expected to buy). After the compact entered into force, MCC funding supported studies of how to expand the right to import fertilizer to a larger set of actors, as well as the establishment of a fund to subsidize the fertilizer purchases of needy farmers. Also, crucially, throughout implementation MCC made various compact funding disbursements conditional on continued advancements in the reform process. The intention of the reform was to make it economically viable for private firms to import and sell fertilizer in Niger, and consequences of this reform have been national in scale. The key assumptions underlying the logic of this reform relate to its sustainability; while annual fertilizer imports more than doubled in 2021 relative to the typical pre-reform year, the 2022 increase in world fertilizer prices caused by Russia’s invasion of Ukraine might have obscured the reform’s success. Moreover, the para-statal that previously oversaw fertilizer importation, while unable to do so now because of the reform, still plays a similarly crucial role overseeing the importation of other agricultural inputs and could continue to lobby for the right to do so for fertilizer as well.

As part of the Mozambique II compact, MCC is supporting revenue-neutral tax reforms which are expected to increase foreign direct investment (FDI) in agriculture. MCC funding will be used to develop a framework for completing fiscal reforms (others of which had already begun before the compact entered into force) to the country’s Value-Added and Corporate Income Taxes. More specifically, a decrease in the statutory rate of the latter from 32% to 10% in the agriculture sector is expected to benefit smallholder farmers via increased tax-favorability of investment in the agriculture sector. The revenue foregone from this tax decrease is expected to be made up by increased Value-Added Tax collections (following the closure of various loopholes).26 Additional reforms will facilitate invoicing between agriculture operators and smallholder farmers, and therefore an increase in direct market transactions between these groups. Key assumptions here are related to the empirical impact of the Corporate Income Tax decrease on FDI and the sustainability of the reform. In this case, there are signs that the government is in fact willing to prioritize investment in the agricultural sector, which seems to bode well for sustainability.

MCC’s role in each of these interventions is more or less limited to the provision of technical support, which in both cases represents a small share of total compact expenditures. However, a salient feature of these interventions is that they are consequential in partner country political economy terms. In general, substantial quantities of political capital might need to be expended to implement key agriculture sector reforms, and the strength of political opposition is an important variable that is not necessarily easily observable. Thus, while the CBAs of the reforms described above were not constructed until key steps in the reform process had already been taken, the likelihood that PIR will actually take place in de facto terms is likely generally hard to know in advance. This uncertainty should motivate economists and their country team colleagues to consider how support for reforms can be bolstered, including via conditions precedent and other compact investments.

General Approach to the Economic Analysis of Agriculture Projects

MCC CBAs compare benefits and costs in counterfactual and with-project scenarios to establish the estimated return on an investment. We focus here on various alternative approaches to estimating the benefits of agriculture projects.27 For these projects, the way benefits are modeled typically amounts to estimating the various ways in which real incomes will increase because of MCC investments. Given typical project logics and objectives for agriculture projects—which usually feature higher incomes as a higher-level objective—modeling benefits in terms of incomes tightly links the CBA to the logic. It also speaks clearly to MCC’s mission of reducing poverty through economic growth. Regardless of whether the objective is to increase farmer incomes, or agribusiness profits and the earnings of their employees, the calculation of benefits therefore usually involves detailed modeling of something like profit functions.

Such functions, by explicitly accounting for the value of inputs and outputs, clarify the channels by which MCC interventions achieve their objectives. For example, farmers can choose the crops they cultivate, the level of inputs to use, and technologies and management practices to employ. Modeling different combinations of farmer choices can aid in understanding the profit-implications of different outcomes, including various with-project scenarios under consideration. It should also be emphasized that financial analyses (using potentially policy-distorted prices) as well as economic analyses (using economic prices) should be performed (for farmers or agribusinesses, depending on the project). This is so that with-project behavior (including take-up or participation) can be analyzed, and the returns for the economy as a whole can be evaluated, respectively.

An alternative to income-based measures of economic returns are welfare approaches that capture changes in consumer surplus due to project-induced changes in the price and consumption of goods and services. Estimates of these surpluses often come from willingness to pay (WTP) studies, using either revealed or stated preferences, that capture the upper limit of consumers’ willingness to purchase a given good or service. Obtaining the difference between each consumer’s upper limit and the actual price paid and summing over all consumers yields a “surplus” that reflects the overall value of the benefit. To take an example from irrigation, a WTP survey might focus on demand for pumped ground water, discharges from a nearby dam, or fees to join a self-sustaining water users’ group. Farmers who use diesel-powered water pumps or carry water long distances implicitly reveal their preference for water through the price of diesel and the time-value of their labor. Obviously, these types of behaviors need to be in evidence for this approach to be feasible, and the accuracy of results will depend on the extent to which the WTP amongst beneficiaries corresponds to that of WTP survey respondents. Such an approach contrasts with a stated preference survey that solicits farmers’ views on water quantities demanded and hypothetical prices.28 While this latter approach does not require data on the demand-related behavioral choices just mentioned, it could be that survey respondents have trouble imagining what they would be willing to pay in the case of sufficiently transformative interventions. CBAs of MCC agriculture projects have not previously been based on these kinds of welfare analyses, but economists should be aware of the possibility they represent.

Also, the Section 1 discussion of agriculture’s role in structural transformation would suggest benefit streams in addition to those associated with farmer or agribusiness net incomes. More specifically, depending on the intervention, we could consider a variety of non-farm income- or agribusiness-related outcomes, including lower food prices, higher off-farm job growth and non-farm economic activities, labor savings, and nutrition-related benefits. These alternative approaches will tend to be more applicable for agriculture projects that differ in important ways from the sorts of projects MCC has historically implemented. This list constitutes a suite of outcomes indicative of broader structural transformation, and we discuss each item in further detail now.

The price of food can be expected to fall given widespread adoption of improved technologies or inputs or decreases in trade barriers, which would be good for all net consumers of food. Higher yields can raise farm incomes, but the effect is often fleeting. This is because yield-enhancing or cost-saving technologies can quickly spread and cause a locally grown commodity’s market supply curve to shift out and its price to predictably fall. Under inelastic demand conditions (which usually apply in the case for staple foods with few substitutes), the price effect more than offsets the gains to yield, resulting in lower revenues per area for farmers. Only the most efficient producers can survive, leaving less competitive actors to return to subsistence or exit on-farm production altogether. Naively, given the impact on producers’ incomes, the effects of yield-enhancing interventions appear perversely harmful. However, the benefits to consumers are potentially enormous. Lower food prices allow households, particularly among the poorest, to satisfy their food requirements and create budget space for housing, health care, and education, as well as other consumer goods purchases, in turn stimulating demand across a range of productive sectors. Employment in urban areas can grow to meet this new demand, often absorbing labor released from the countryside. In short, higher yields can raise consumers’ well-being and drive the mechanisms behind structural transformation. To be clear, no evaluation has demonstrated that MCC has caused yield increases on the scale discussed here, but it is important to highlight the potential benefits of doing so.

A subset of cost-reducing inputs, labor-saving technologies can trigger new household dynamics that also generate benefits as they contribute to structural transformation. Mechanization (via tractors or combines, for example) is the primary labor-saving factor, but chemical inputs and certain seed varieties can also reduce labor hours in the field. Within the household, reduced demand for labor frees time for more off-farm (or farm-adjacent) employment opportunities. This includes cottage industries revolving around food processing and preservation. To the extent these new options result in higher incomes, benefits would be generated. Relieved from field work, school age members of the household, particularly girls, can receive more years of formal education and build their human capital. The implications of higher human capital for women’s long-run wages and fertility are straightforward and well-documented (see Quisumbing et al., 2014). Finally, of course, households also benefit from relying less on hired help to carry out labor-intensive tasks.

In principle, interventions in input markets can raise demand for complementary agricultural goods and services, which could generate off-farm benefits. For example, reducing barriers to fertilizer access (e.g., lowering import tariffs) not only raises the quantity demanded for fertilizer, but additional inputs that potentially compound fertilizer’s benefits, such as boreholes for irrigation, higher yielding seed varieties, or tractor rentals and sales. Accompanying these additional inputs are technical consultation services (i.e., agricultural extension), that impart agronomic know-how, management skills, and market information onto local producers. Commercial providers of these bundles of goods and services grow in response to this greater demand, stimulating job growth and investment in the input sector. These are referred to as indirect benefits, and their estimation should be done in accordance with MCC EA’s general CBA guidance. Notably, for these indirect benefits to be additional to the direct benefits described above, there needs to be a distortion affecting the relevant input market (e.g., the presence of unemployment such that increased employment represents net income gains, or distortions which result in the undersupply of complementary inputs).29 On the output market side, as production grows and the food supply shifts, downstream value addition becomes more feasible. With irrigation or other interventions driving more production and the availability of greater storage capacities, scale economies become feasible for food processors, stimulating investments in labor-intensive manufacturing sectors. These are referred to as induced benefits, and as the general CBA guidance notes, they are typically difficult to measure and in practical terms indistinguishable between projects.30

Finally, for projects in which farmers or others might benefit from increased production of food crops, we might consider benefits related to improved nutrition. The standard assumption would be that the value of the nutrition a food contains would be reflected—like all other characteristics of the food—in the food’s price. Thus, in the case of a project where some set of farmers increase production of a relatively nutritious crop, the value of that nutrition would be accounted for by simply accounting for the aggregate value of output produced using observed prices (as described in more detail in Section 4). In principle, however, market prices might not reflect nutrition-related benefits (say, if the latter were unknown to and therefore not valued by some set of consumers). In this scenario, market prices would understate the social benefits of the agricultural output in question. To account for nutrition-related benefits without double-counting, however, economists would need good evidence that prices do not in fact account for nutrition as well as a credible estimate of the incremental value of the nutrition.31

Detailed Estimation of Project Benefits

Farmer Net Incomes

MCC agriculture projects are typically intended to increase the net value of agricultural production at the level of the beneficiaries’ farms. Modeling this outcome therefore requires consideration of the value of agricultural output as well as the costs of inputs used to produce that output. These things need to be modeled for both counterfactual and with-project scenarios, and typically separately for a variety of crops and multiple seasons. All of this makes for a conceptually straightforward but highly data-intensive modeling experience: data on output prices, crop choices, yields, farm budgets and more are needed—for multiple crops and seasons—to construct indicators of the value of agricultural output and the economic value of inputs. These two aggregate indicators are similar to agricultural revenues and costs, respectively, and by subtracting the latter from the former we have something like agricultural profits (i.e., the net value of agricultural output). This single indicator goes a long way towards characterizing economic outcomes in each of the counterfactual and with-project scenarios, and farm-specific benefits are typically equal to the difference in this indicator’s values (in aggregate terms) across these two scenarios. We turn now to how the net value of agricultural production can be modeled in the counterfactual scenario, and we note that what follows is relevant for any irrigation, value addition, and natural resource management projects which aim to increase net farm incomes.

Modeling the Net Value of Agricultural Output in the Counterfactual Scenario

Again, there are many empirical questions that need to be answered before the net value of agricultural output can be estimated, each of which we consider below:

- How many seasons do farmers typically cultivate crops in?

- Which crops do farmers grow and what shares of their plots are devoted to the cultivation of each of these crops?

- What are output prices?

- What yields do farmers achieve on average, and what share of value is lost to spoilage?

- Which inputs do farmers use, in what quantities, and at what costs?

- What is the total area subject to cultivation in question, how many beneficiary farmers are there, and what are average beneficiary farmer plot sizes?

Knowing the answers to these questions generally suffices to allow for the calculation of the net value of agricultural output, which is of course necessary to construct the CBA. But in addition, understanding the issues that these questions raise will have important implications for project design. However farming in the with-project scenario is envisioned, understanding how farming is currently practiced will clarify the ways and extents to which farmers are expected to change their behaviors. Economists should therefore plan on working particularly closely with Land and Agricultural Economy (LAE) colleagues to understand the issues outlined below.

Planting Seasons: The question of how many seasons farmers typically cultivate crops in is of primary importance for all agriculture (and especially irrigation) projects, which usually have as a key benefit stream that farmers will be able to cultivate in (at least) one additional season with the project. This additional season is typically the dry one, when more lucrative horticulture cultivation is more common, and the associated impacts on farm incomes can be dramatic. Benefits associated with intensification therefore normally constitute a large share of irrigation project benefits, for projects which aim to rehabilitate existing irrigation systems as well as projects which provide improved irrigation for some set of farmers for the first time. Given the economic importance of this question of in how many seasons per year farmers typically cultivate crops, economists should plan on seeking reliable data on this or overseeing the collection of such data (if it was not already obtained at an earlier stage of the due diligence process). It should also be noted that even if most farmers do not cultivate crops outside of the rainy season, a small minority might do so (for example, with the use of wells), and it could be important to understand the extent to which off-season cultivation is already practiced. Project beneficiaries who would cultivate in multiple seasons without the project would presumably experience smaller income increases than other beneficiaries, and it could be useful to understand the extent to which off-season cultivation was already familiar to and profitable for local farmers.

Crop Choice: The crops that farmers choose to grow are powerful determinants of their incomes and strong indicators of their tolerance for risk. In many MCC agriculture project settings, farmers cultivate low-value but weather-robust staple crops almost exclusively, even as more lucrative crops would result in considerably higher incomes in expectation. This might suffice to convince us that would-be beneficiary farmers do not have as their objective the maximization of expected income, and in fact what farmers seek is something like the minimization of the risk of a failed crop and subsequent hunger. To illustrate with an example from Niger, under conservative assumptions, almost all farmers with access to irrigated plots on the Konni irrigated perimeter forego (in expectation) hundreds or even thousands of dollars in agricultural profits each rainy season by cultivating staples rather than some combination of onions and tomatoes.32 With this kind of behavior in mind, the question of how to convince such farmers to depart from a nearly exclusive focus on staple crop cultivation should receive serious consideration during the project design phase.33 Finally, given the economic importance of crop choice, economists should have reliable data on both the crops that beneficiary farmers grow and the share of their plots devoted to each crop. Ideally, these data would be sampled directly from the beneficiary population in the case of survey-based data collection, and they can potentially be observed directly for the beneficiary population using remote sensing methods. Such data might be readily available in the case of projects involving the rehabilitation of existing irrigated perimeters, and economists should consult with governing institutions accordingly. When new data collection is not feasible, data on region-wide crop choices might be used.

Prices: Agricultural output prices are another key input for CBAs of projects that intend to increase farm incomes, since they are used to determine the value of agricultural output. In particular, per-unit output prices are multiplied by quantities produced to obtain an estimate of the gross value of agricultural output. Note that output that is consumed within the farmer’s own household is valued in the same way as output that is sold. Economists should be aware that, to the extent to which output that is consumed is less valuable (e.g., for reasons of taste or quality) than output that is sold, treating both types of output as if they have the same value will overstate the gross value of agricultural output.34 Also, data permitting, economists should consider whether agricultural output that was set aside for own consumption but subsequently wasted should be valued positively or not.35

Economists should be aware of the distinction between economic and financial prices. The latter would correspond to what farmers would report having received per unit of output and be useful in modeling farmer production choices (which would naturally be based on the prices that farmers face, regardless of how those might be distorted). Economic prices, on the other hand, are meant to reflect the social value of agricultural output, and when available are preferable for inclusion in the CBA. The data requirements associated with modeling the latter are substantial, however, and require data on a variety of specific costs as well as the conversion factors used to account for distortions in prices. Tables 2 and 3 illustrate how to obtain financial and economic prices for agricultural output which substitutes for imports and is exported, respectively. See Jenkins et al. (2019) for more on how financial and economic prices should be calculated.36

Table 2: Calculation of Financial and Economic Values at the Farm Gate of Import Substitute Agricultural Output Financial Value Economic Value CIF price CIF price PLUS any applicable import tariffs PLUS the value of the foreign exchange saved PLUS financial costs of handling and transportation between the border and the main, in-country market PLUS economic (distortion-corrected) costs of handling and transportation between the border and the main, in-country market MINUS financial costs of transportation from the processing facility to the main, in-country market MINUS economic (distortion-corrected) costs of transportation from the processing facility to the main, in-country market MINUS all financial agricultural processing costs MINUS all economic (distortion-corrected) agricultural processing costs MINUS financial costs of handling and transportation from the farm gate to the processing facility MINUS economic (distortion-corrected) costs of handling and transportation from the farm gate to the processing facility Table 3: Calculation of Financial and Economic Values at the Farm Gate of Agricultural Output for Export Financial Value Economic Value FOB price FOB price MINUS any applicable export tariffs PLUS the value of foreign exchange earned MINUS financial costs of handling and transportation between the project site and the border MINUS economic (distortion-adjusted) costs of handling and transportation between the project site and the border

In general, is it not possible to say whether economic prices will be larger or smaller than financial ones. For example, the economic prices of import substitutes will be increased relative to financial prices by the foreign exchange premium, import tariffs push financial prices up relative to economic ones, and distortions in handling and transportation prices have an ambiguous effect. In cases where the unavailability of data prevents estimation of economic prices according to the textbook method, it is acceptable to simply rely on relatively easily observed financial prices for inclusion in the CBA. Where prices are subject to major distortions such as clearly binding price ceilings or floors, however, economists should consider the possibility of adjusting relatively easily observed values in consideration of the estimated magnitude of distortions. In any case, financial price data is ideally drawn from sales that take place at the farm gate, to reflect values that are most relevant for farmers. Price data collected in markets (including markets geographically close to beneficiary farmers), for example, might feature prices that are considerably higher than whatever amounts farmers received, thanks to non-trivial marketing margins for middlemen and transportation costs.

Economists should also ensure that data on observed prices corresponds to the degree of processing that the output has been subjected to (since processed output will be priced higher than unprocessed output). Price data is ideally obtained for multiple years so that averages can be taken, and the values entered in the CBA do not reflect inter-annual price variation to an excessive degree. If multiple sources for price data (of a given level of quality) are available and they are jointly controversial, economists should err on the side of being conservative by choosing minimum values for inclusion in the model. Given the economic importance of agriculture in many MCC partner countries, the possibility of there being multiple sources of price data is not as unlikely as it may sound, including in countries where public data collection efforts are inadequate. For example, agricultural research institutes might have price data, and the Food and Agriculture Organization (FAO) is also frequently a useful reference, at least for staple crops.37 Of course, if beneficiary farmers have been surveyed using reliable methodologies with respect to recent output prices received, it should be clear which of multiple sources are plausibly most accurate. Also, output prices generally exhibit variation across seasons as well as years, and the accuracy of the CBA will therefore depend on the availability of season-specific data. Economists should also be aware that output prices received could vary with the quantity sold (in settings where buyers offer bulk premiums).

How might agricultural output prices be expected to change over time? Depending on the context, economists might examine whether food prices can be expected to exhibit secular changes. For example, rising national or world demand for food or climate change could each be expected to increase food prices over the medium and long terms. On the other hand, there are examples of MCC irrigation projects where price collapses occurred, potentially driven by an increase in supply in the face of lack of access to more distant markets. These served as the motivation behind investments in roads near the sites of subsequent agriculture projects. Economists should therefore inquire of their LAE colleagues whether beneficiary farmers who would cultivate more lucrative horticulture crops using improved irrigation have access to markets large enough that they would be price takers. In the absence of good evidence to suggest that output prices will change over time, however, economists might make the default assumption that past prices can simply be projected forward.38

Yields: Many MCC agriculture projects are heavily focused on yields, or the quantity (measured by weight) of agricultural output produced per hectare. Yields are ideally measured at the level of beneficiary farmers’ plots, but in the absence of the requisite data, regional yield data might suffice (particularly if it covers each of the crops that beneficiaries would be expected to cultivate in the counterfactual scenario, and there is little reason to think that outcomes in project locations differ from the region as a whole). Again, if public organizations or ministries have not collected relevant yield data, agricultural research institutes and the FAO should be thought of as possible sources.39 Economists should be aware that yield data from crop cut surveys is most accurate, but household surveys and satellite-based collection can also provide data of acceptable quality.40,41

Given the typical magnitude of inter-annual variation in yields, counterfactual yield values would ideally be drawn from multiple years’ worth of observations. As in the case of output prices, yields can be substantially affected by year-specific events like rainfall shocks, and economists should evaluate a single year’s worth of yield data with this in mind. Modeling yields over time also raises some of the same questions related to secular changes as modeling output prices does, and for some of the same reasons (e.g., climate change, increased demand for agricultural output). If drought or flooding is expected to become more common, failing to account for this in the counterfactual would contribute to the underestimation of benefits. There is also the possibility that that yields might have been growing over time due to periodic technological improvements, and that these secular improvements can be expected to continue. To the extent that historical data provides evidence of these various gradual changes, and in the absence of good evidence that trends will change, the default assumption should be that observed historical trends will continue to hold. Also, to the extent that any crops are cultivated across seasons in the counterfactual scenario, average yields can be expected to vary across seasons (e.g., because pests might be more of a factor during the rainy season), and season-specific estimates of yields are therefore important to have.

Inputs: Consistent with general MCC CBA guidance, economists must also account for the monetarized opportunity costs of all inputs used in the production of agricultural output in the counterfactual scenario. This includes the costs of capital, materials such as fertilizer, pesticides, insecticides, water, seeds, and materials associated with the harvest such as nets or bags. Again, for the CBA, costs should reflect social costs rather than merely the price that farmers pay for a unit of some input; the price farmers face for the latter could be distorted (e.g., in the case of subsidized fertilizer), or farmers could ignore the external costs to others of their use of some scarce resource (e.g., water from a non-renewable source), whereas what the CBA would ideally reflect is the cost to everyone everywhere of a unit of some input. Again, economists should be mindful of this distinction between financial and economic prices, and several of the points above regarding output prices also apply to inputs: estimating economic prices using the textbook method is information-intensive, it is an empirical question as to whether economic prices exceed financial ones, and economists should consider making informed adjustments to available (likely financial) input prices when estimating economic prices is not feasible but distortions are known to be large. Table 4 illustrates the steps necessary to estimate the financial and economic costs of inputs.42

Table 4: Calculation of Financial and Economic Values of Imported Agricultural Inputs Financial Value Economic Value CIF price CIF price PLUS any applicable tariffs PLUS the value of foreign exchange expended PLUS financial costs of handling and transportation from the border to the main, in-country market PLUS economic (distortion-corrected) costs of handling and transportation from the border to the main, in-country market PLUS financial costs of handling and transportation from the main, in-country market to the farm gate PLUS economic (distortion-corrected) costs of handling and transportation from the main, in-country market to the farm gate

The modeling of input quantities used—which generally varies by crop as well as season—will depend heavily on empirical evidence, ideally drawn from a representative sample of beneficiary farmers. In the absence of that, economists should seek this large volume of detailed information from local experts such as agricultural extension specialists, local or regional agricultural research institutions, or LAE colleagues and their consultants.

Economists also need to account for the quantity and value of any labor used to cultivate crops. This includes hired as well as family labor, each of which might be used for a wide variety of tasks such as clearing fields, planting, applying fertilizer, harvesting output, and potentially subsequent processing activities. All labor should be valued according to its most likely or feasible alternative use, which could be the local wage for unskilled labor (if employment rates are high) or zero (if labor would otherwise be unemployed). For the same reason, economists should seek to understand the extent of seasonal migration and the unskilled wages that migrant members of farm households might earn (particularly during seasons when cultivation is rare).43 Again, much of this requires highly context-specific information, and if economists do not organize and help manage surveys to observe it directly, they should plan on relying on local experts. Finally, regardless of the data sources underlying the modeling of input costs, with all their many estimates related to quantities used and unit costs, economists should also seek to verify that their end results-crop- and season-specific estimates of input costs—sound plausible to experts. Such experts could have a well-founded sense of what it costs farmers to cultivate a given crop during a given season, and any bottom-up modeling of input costs can usefully be presented to experts for their consideration and feedback.

The model elements described thus far allow for the estimation of the net value of agricultural output on a per hectare or per farm basis. To estimate the aggregate value of agricultural output net of costs in the counterfactual scenario, however, we need to multiply the former quantity by the total footprint size of the irrigation project or the total number of beneficiary farmers, respectively. Operational colleagues usually have plans or targets along these lines, and this final step in the counterfactual modeling process is therefore straightforward. But before we move on to discuss the modeling of the with-project scenario, and apart from whatever might have been learned from the root cause analysis and existing research, it is worth highlighting the insights that a solid model of the counterfactual might offer.

A first question we should ask is what our model of the counterfactual seems to be telling us about farmers’ living standards. Are farmers earning a comfortable living, or are they near subsistence? In the case of many MCC partner countries, farmer incomes are extremely low, and the model of the counterfactual should illustrate why by shedding light on farmers’ behavioral choices: Are farmers willing to take risks with respect to crop choices or input usage, or do they seem unwilling to invest in these ways? How widespread is experience cultivating more lucrative crops, and to what extent do farmers seem focused on the cultivation of relatively hardy staple crops? More generally, is agriculture characterized by a lack of dynamism? Perhaps most importantly for program design purposes, do farmers seem to behave as if they are trying to maximize their (net) incomes, or is their primary objective perhaps more related to household food security and minimizing the likelihood of experiencing crop failure? Once we have enough data to estimate counterfactual farm net incomes, we also likely know enough to estimate what the highest net income a farmer could earn is (given output prices, yields, and so on for the crops that any farmer cultivates). Economists should perform this calculation and then take note of the degree to which actual farmer behavior diverges from this income-maximizing set of production choices over crop choice, input usage, and so on.

Answering these questions is crucial because it gives us a sense of where farmers are starting from and along which dimensions we would hope they adjust following MCC’s intervention. In turn, we gain insight into where due diligence should be conducted so that project design can be improved, the assumptions underlying the project logic, and the scale of a project’s ambitions. Economists should ask whether these ambitions are realistic. How much can we expect farmers’ behaviors to change given those farmers’ apparent objectives, even if we are successful in achieving our output targets (e.g., by providing irrigation, training, or credit)? On the one hand, MCC interventions sometimes seem to have the potential to be life-changing, but on the other, farmers tend to be conservative with respect to the adoption of inputs and new techniques, and in some MCC partner country settings farmers may not behave as if their objective is simply to maximize expected income. One question we might therefore ask is how far farmers might be willing to go in the direction of increasing their net incomes, which we turn to now.

Project Impacts and Modeling Net Farmer Income in the With-Project Scenario

Irrigation Project Impacts and the With-Project Scenario